Welcome to Sino Bearings web

24x7 HOTLINE:+86-28-81454188

NEWS

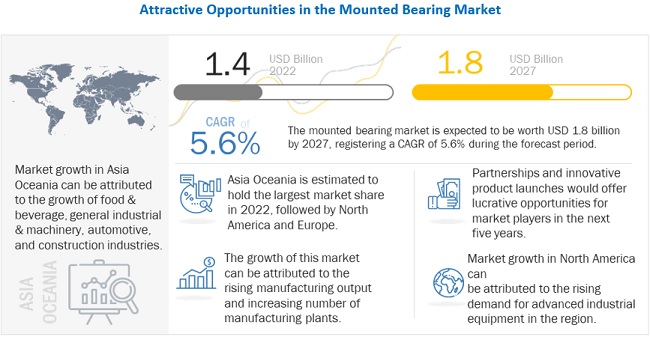

NEWS[273 Pages Report] The global mounted bearing market size is projected to grow from USD 1.4 billion in 2022 to USD 1.8 billion by 2027, at a CAGR of 5.6%. The base year for the report is 2021, and the forecast period is from 2022 to 2027. The mounted bearing market is driven by adoption of mounted bearings in numerous industries; increased efficiency and long life with less maintenance requirements of mounted bearing; growing demand for specialized bearings for cost optimization; and increasing development and adoption of sensor-based bearing units and IoT.

To know about the assumptions considered for the study, Request for Free Sample Report

Almost all the industries faced challenges because of the COVID-19 outbreak. The pandemic resulted in a sharp decline in demand for and investments in mounted bearings worldwide in 2020. Various industries, such as mining, construction, and food and beverage, struggled due to the abrupt halt in production. Suspension of production and focus on the health safety of employees and workers have disrupted the supply chain of various industries. A sudden impact on the economy, along with restrictions on the movement of people and goods, has caused a sharp contraction in GDPs as well as various manufacturing sectors’ output worldwide. Production and sales continuously declined due to the pandemic. Companies across different industries followed various measures to keep their business sustainable. Many companies have even shifted their line of operations during the pandemic.

The COVID-19 pandemic has had a negative impact on the revenue generation of mounted bearing manufacturers. For instance, NSK’s revenue declined from USD 9.0 billion in 2019 to USD 7.7 billion in 2020. Similarly, Rexnord Corporation’s revenue declined from USD 3.2 billion in 2019 to USD 2.9 in 2020. However, Timken showcased positive growth in its revenue in 2020 with USD 3.7 billion as compared to USD 3.5 billion in 2019.

The increasing adoption of mounted bearings in major industries such as food & beverages, mining & minerals, and pulp & paper drive the mounted bearing market.

According to the US Department of Agriculture (USDA), food processing plants accounted for a share of 15% of the value of shipments from the US in 2018. Meat processing, dairy, and beverages contributed 24%, 13%, and 12%, respectively, to the total food processing shipment in the same year. Improved economic conditions and increased consumption would likely boost the demand for machinery for food processing. The USDA invested USD 500 million for the expansion of meat and poultry processing capacity. It invested USD 150 million in existing small poultry processing facilities to help them cope with their declining business due to the COVID-19 outbreak. The USDA also invested USD 100 million to develop a better food system to support small poultry and meat processing plants. The investment is to reduce the financial burden arising due to overtime inspection fees for small meat, poultry, and egg processing plants, thus enabling farmers with local alternatives as well as a greater capacity to process livestock. According to the US Department of Agriculture, the American agricultural industry witnessed a rise in export levels in 2021. The export of the US farm and food products totaled USD 177 billion, which is an 18% rise compared to 2020. China was the major exporter, with the export of agriculture products worth USD 33 billion, which is 25% more compared to 2020, followed by Mexico with USD 25.5 billion, a 39% rise from 2020. Stringent food safety standards and the adoption of new technologies drive the demand for premium mounted bearings. The achievement of efficient material handling through conveyers is also expected to increase the demand for mounted bearings in the food processing industry. Despite the COVID-19 outbreak, 20 major material handling system companies witnessed a rise in revenues in 2020. Major players such as Daifuku Co., Ltd., Dematic (KION Group), Vanderlande, and Knapp AG generated a revenue of USD 25.9 billion in 2020, which was USD 23.2 billion in 2019, representing an 11.7% increase. Mounted bearings are used in packaging and pallet wrapping applications as well.

Counterfeit bearings are a major restraint in the mounted bearing market. Counterfeit bearings lead to higher costs, risks, and reduced machine reliability with frequent bearing failures. These bearings are manufactured using low-grade materials that are often processed on aging machines operated by minimum-wage operatives. Packaging of these counterfeit bearings makes them look like a replica of original products, making it tough for customers to differentiate between the counterfeit and original products. These poor-quality products fail more often when put into service, thus increasing the associated maintenance and purchasing costs–and these increased costs are invariably much higher than the amount saved on the unit price of the bearings when they were purchased. According to industry experts, in most cases, distributors are held responsible for the distribution of counterfeit bearings, and counterfeit suppliers intend to make much more profit on the transactions than they would have done supplying the original bearings. Counterfeit products are present in large numbers and are not limited to certain regions. It is also common to find large-size products, hence they are not limited to small-size bearings. The counterfeit bearing production exists in many countries. Various customs seizures of these counterfeit bearings in the US and European Union originate from China. Raids are being conducted against counterfeit sellers in Europe, the US, and different countries of Africa, Latin America, and Asia. But such raids are helpful only to a certain degree.

Sensors are essential in industrial automation as well as motion control systems. They are the vital link between the data collected through physical systems and the communication link that transmits data to the monitoring facilities or cloud. Sensors are used to keep a check on the performances of bearings, as a failed bearing could lead to costly downtime. The smart sensor technology provides an early indication of any potential problem through assessing the condition of bearings such as vibrations as well as temperature information. It has application in bulk material handling conveyors that are typically found in the industries such as aggregate, mining, grain handling as well as cement along with the food and beverage as well as air handling sectors.

The IIoT (Industrial IoT) sensor is a complex combination of software and hardware. IIoT sensors could be used as acoustic and chemical sensors to liquid levels and temperature monitoring sensors. A proximity sensor is another type of sensor, which is mounted onto bearings. IoT sensors are not limited to the collection and sending of data but include processing and decision-making functions as well. This added function saves engineering time as well as cost.

The risk of failure is a major challenge for the manufacturers of mounted bearings. The sudden failure of bearings could lead to unplanned downtime and premature replacement of bearings. Some of the major reasons for the failure of bearings are:

Excessive load: Excessive loads usually cause premature fatigue. Tight fits and improper preloading can also ring about early failure.

Overheating: Symptoms are discoloration of the rings, balls, and cages from gold to blue. Temperatures in excess of 400°F can anneal the ring and ball materials. The resulting loss in hardness reduces the bearing capacity causing early failure. In extreme cases, balls and rings will deform. The temperature rise can also degrade or destroy the lubricant.

True brinelling: Brinelling occurs when loads exceed the elastic limit of the ring material. Brinell marks show as indentations in the raceways, which increases bearing vibration (noise). Severe Brinell marks can cause premature fatigue failure.

Normal fatigue failure: Spalling can occur on the inner ring, outer ring, or balls. This type of failure is progressive and, once initiated, will spread because of further operation. It will always be accompanied by a marked increase in vibration, indicating an abnormality.

To know about the assumptions considered for the study, download the pdf brochure

Several years of strong supplies, associated with slow growth in demand, have exerted downward pressure on the international prices of most agricultural commodities, with cereal, beef, and sheep meat prices showing short-term rebounds. Productivity growth in agriculture is expected to stay ahead of food demand. The growing global population will continue to use increasing amounts of agricultural products as food, feed, and for industrial purposes. Much of the additional food demand over the coming decade will originate in regions with high population growth, in particular, Sub-Saharan Africa, South Asia, and the Middle East and North Africa. In the agriculture industry, the demand for machinery and equipment is growing to ease operations, increase productivity, and enhance efficiency. The mechanization of various activities and the increased performance of machines and equipment has enabled the processing of heavier objects and the cultivation of larger areas. Some of the key equipment used are horizontal and vertical conveyors, worm conveyors, various auxiliary transmissions, ploughs, and harvesters. As a result, the demand for equipment parts and bearings in the industry is growing, which will drive the mounted bearing market. Healthy demand for equipment that uses mounted bearings has also been seen in the farming and fishery industries.

The conveyors segment is estimated to be the largest in the global mounted bearings market, by equipment type. The growth of the segment can be attributed to the extensive use of conveyors in the construction, manufacturing, paper, automotive, mining, and mineral industries. Conveyors can be used to transfer light as well as heavy or bulky material efficiently. Large conveyor applications in industries require multiple types of bearings, which drives the growth of this segment in the mounted bearings market.

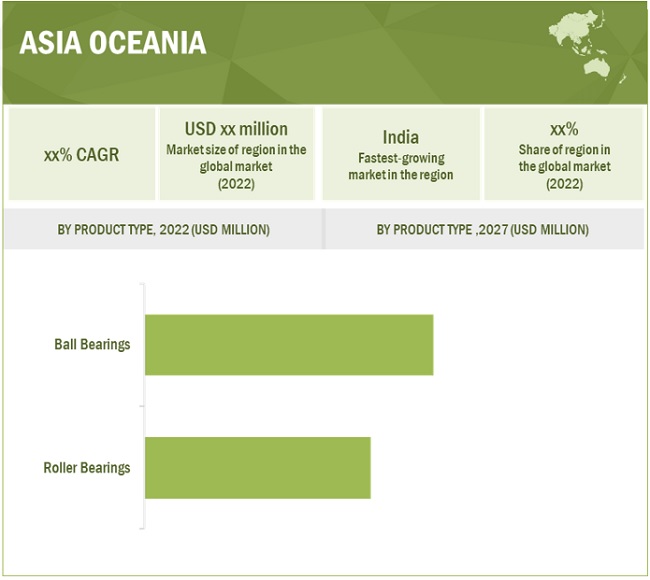

Growing focus on infrastructure developments to accommodate the growing population would represent a suitable business environment for manufacturers in the steel, cement, and metal processing sectors. Major economies are expected to outline economic packages to boost the growth of small and medium companies to combat the downward economic trend due to the COVID-19 pandemic. Countries such as China and Japan would be key growth drivers of the Asia Oceania mounted bearing market. Companies have established manufacturing bases in this region, and countries in this region act as major export hubs. Bearing manufacturers such as SKF (Sweden), JTEKT Corporation (Japan), FYH Inc.(Japan), and NTN (Japan) have a strong presence in this region. These manufacturers are rapidly expanding their presence in this region to increase their market share for industrial bearings.

The market in the region is competitive; the development of low-cost bearing solutions is likely to increase as companies in the manufacturing industry are looking for measures to reduce production costs.

The global mounted bearing market is dominated by major players such as SKF (Sweden), Schaeffler (Germany), Timken (US), and NSK (Japan). These companies offer a wide variety of mounted bearing fulfilling all major functions and applications in various end-use industries. The key strategies adopted by these companies to sustain their market position are new product developments, expansions, mergers &acquisitions, and partnerships & collaboration.

Click on image to enlarge

Click on image to enlarge|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Product type, housing block type, end-use industry type, equipment type, market channel, and Region |

|

Geographies covered |

Asia Oceania, Europe, Latin America, Middle East & Africa, and North America |

|

Companies Covered |

SKF (Sweden), Schaeffler (Germany), Timken (US), NSK (Japan), and NTN (Japan). |

This research report categorizes the mounted bearing market based on product type, housing type, end-use industry type, equipment type, market channel, and region.